Tax bracket calculator 2020

Quickly figure your 2021 tax by entering your filing status and income. Your Federal taxes are estimated at 0.

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Effective tax rate 172.

. A tax bracket is a category used to define your highest possible tax rate based on your filing status and taxable income. Calculate your 2021 tax. 10 12 22 24 32 35 and 37.

Our W-4 Calculator can help you determine how to update your W-4 to get your desired tax. 2020 Tax Brackets Due April 15 2021 Tax rate Single filers Married filing jointly Married filing separately Head of household. The minimum tax bracket in the US is 10.

Calculate your income tax bracket 2021 2022. Up to 10 cash back TaxActs free tax bracket calculator is a simple easy way to estimate your federal income tax bracket and total tax. Married filing jointly.

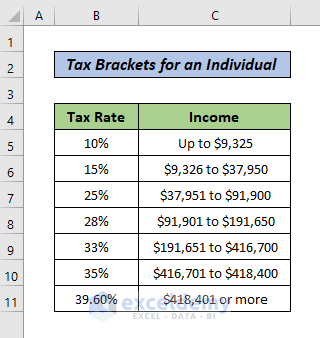

The current tax rates 2017 consist of 10 15 25 28 33 35 and 396. The new 2018 tax brackets are. Your tax bracket is.

In other words your income determines the bracket you will be. There are seven tax brackets for most ordinary income for the 2020 tax year. Bentle K Berlin J and.

Single Married Filing Jointly Married. 2021-2022 Capital Gains Tax Rates and Calculator. Tax calculator is for 2021 tax year only.

0 would also be your average tax rate. This calculator helps you to calculate the tax you owe on your taxable income for the full income year. This is 0 of your total income of 0.

Your tax bracket depends on your taxable income and your. To lower the amount you owe the simplest way is to adjust your tax withholdings on your W-4. See how tax brackets work how to cut your taxes.

That means your tax rate would. It is mainly intended for residents of the US. Estimate how much youll owe in federal taxes using your income deductions and credits all in just a few steps with our tax calculator.

What Is a W. The current tax rates 2017 consist of 10 15 25 28 33 35 and 396. As of 2016 there are a total of seven tax brackets.

Estimate your tax refund with HR Blocks free income tax calculator. The AI-powered tax engine finds every possible tax deduction to. 2020 tax brackets and rates.

The tax bracket calculator is one of many FlyFin features geared specifically toward freelancers and the self-employed. It can be used for the 201314 to 202122 income years. Do not use the calculator for 540 2EZ or prior tax years.

The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return. And is based on the tax brackets of 2021 and. Its never been easier to calculate how much you may get back or owe with our tax estimator tool.

Teachers Income Tax Model Calculation For Ap Telangqana Employees It Calculator Tax Software Teacher Income Income Tax

Inkwiry Federal Income Tax Brackets

Free Tax Resources Tools And Tips To Simplify Tax Season Lili Banking

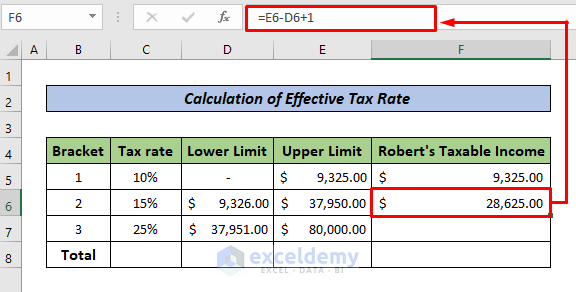

How To Calculate Federal Tax Rate In Excel With Easy Steps

Calculate Your Net Income Manitoba Give Tax Rates Pensions Contributions And More Net Income Income Tax Income

Find The Federal And State Income Tax Forms You Need For 2019 Official Irs Tax Forms With Instructions Are Printable And Can Be Income Tax Irs Taxes Tax Forms

How To Calculate Foreigner S Income Tax In China China Admissions

How To Calculate Federal Tax Rate In Excel With Easy Steps

Sujit Talukder On Twitter Online Taxes Budgeting Income Tax

Download Roth Ira Calculator Excel Template Exceldatapro Roth Ira Calculator Roth Ira Ira

Excel Formula Income Tax Bracket Calculation Exceljet

How To Calculate Federal Income Tax

Income Tax Calculation A Y 2021 22 New Income Tax Rates 2021 New Tax V S Old Tax A Y 2021 22 Youtube

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Tax Brackets For Self Employed Individuals In 2020 Shared Economy Tax

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Income Tax Calculator For Fy 2019 20 Fy 2020 21 Eztax In Help